Contents

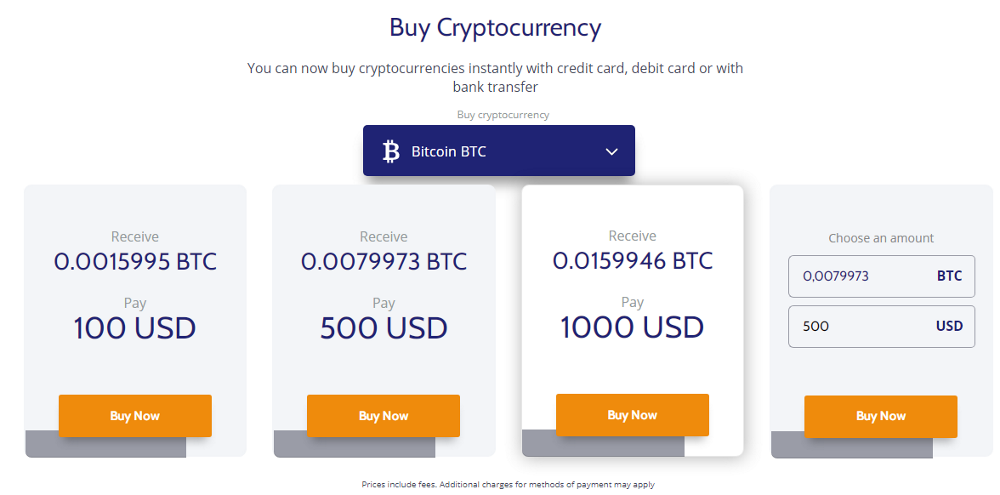

We offer you the most profitable and reliable cloud mining contracts by providing daily payouts for all the contracts in the currency of the contract. Start cryptocurrency and stablecoins cloud mining today, and get the first payout tomorrow! Trade Crypto, Forex CFDs and earn up to 95% extra income in 60 seconds on IQMining platform. Pledge your cloud mining contract and get up to 100% of its price and multiply your income trading cryptocurrencies.

The regulatory authorities & is always considered safe, so always check for regulations before starting trading. Might not allow CAD to be a part of the currency pairs as a payment method and trading cost for exchanging. That can help beginners, day traders, and advanced traders and help them understand account type, thus get started with easy and seamless use. The broker’s fixed spread is more comprehensive when compared with standard spreads and does not have any commissions involved. Fortrade does not charge commissions, but instead, they add costs hidden into the tight spreads. The top brokers provide advanced education and research resources along with a range of research tools.

The average spread for the EUR/USD currency pair is a competitive 1.065 pips. The company’s research and insights go above and beyond some competitors. So, why consider a forex broker in Canada when some other countries https://broker-review.org/ offer traders world renowned brokers that adhere to strict regulation? Forex Brokers in the U.K and U.S specifically are one of the most trusted across the globe due to their customer focused regulations.

How do forex brokers make money?

Major pairs, such as CAD/USD, are often available, but minor and exotic pairs, like CAD/ZAR, are less commonly traded. In any case, a good forex broker in Canada should offer a wide selection of currency pairs. Although Canadian citizens can choose to trade with any forex broker across the globe, there are distinct advantages to trading with forex brokers in Canada, including world renowned security of client funds. SaxoTraderGO is web-based and features 58 indicators and 19 drawing tools.

Any broker that wants to operate in Canada must be licensed by IIROC. If you’re a forex trader from Canada, then it is advisable that you only trade through forex brokers that are regulated by the IIROC. This is because such brokers are considered to be safe and you can have legal recourse against them in case of any fraudulent behavior.

- In terms of fees, Avatrade utilises a 0% commission structure, which means that you don’t have to pay any transaction fees when you place a trade.

- Their own trading platform is called Next Generation and can support Windows, Mac, iOS, iPad, and Android.

- Modern high-speed trading platform, with simple trading features.

- For instance, some may have commission fees (mostly, brokers cover fees for you, but there’s still a chance), some may have a longer waiting period for transactions.

It is a highly speculative market that can be both rewarding and risky. In Canada, the regulation of the forex market is overseen by the Investment Industry Regulatory Organization of Canada and the Canadian Securities Administrators . We found that Avatrade is the best forex broker for Canadian clients. This is because Avatrade does not charge any commissions when opening a position and offer full support for MT4 and MT5. The minimum deposit at Forex.com is only $100 and can be made via credit/debit card, bank transfer, or various e-wallets.

Customer support

Before starting, remember trading CFDs carries risk, and you may lose money, so always be careful. On top of the trading account types, always make a point to check the terms and conditions for withdrawals which are attached to the different types of trading account. FOREX.com, registered with the Commodity Futures Trading Commission , lets you trade a wide range of forex markets plus spot metals with low pricing and fast, quality execution on every trade. However, what they give up they get back in the substantial protection offered by the Canadian Investor Protection Fund. And there are a limited number of brokers who operate within Canada.

Our research is based on 9 factors including the trading and non-trading fees, trading platforms, customer support, withdrawal time & other factors. Forex trading platforms and forex brokers enable users to trade currencies on the forex market. Forex trading platforms offer tools to be an effective forex trader, from beginner to advanced. Compare the best Forex Trading platforms in Canada currently available using the table below. Fusion Markets is a well regulated broker that offers more than 250 financial products to trade in across a number of the most popular markets in the industry. Firstly, in terms of forex trading, there are more than 90 currency pairs available.

How Are Canadian Forex Traders Protected? 🛡️

You should be aware that you may lose a significant portion of your portfolio. The Investment Industry Regulatory Organization of Canada is the national self-regulatory organization which oversees all investment dealers and trading activity on debt and equity marketplaces in Canada. Trading in Forex/ CFDs and Other Derivatives is highly speculative and carries a high level of risk.

For example, there are different leverage and margin rules between Forex brokers in Canada versus the US. Also, many Forex brokers in the US will not accept accounts from Canadian residents. If you are looking for a broker that offers the best currency trading platform in Canada for your trading needs, all the trading platforms offered globally are available from Forex brokers in Canada.

It facilitates and offers access to international markets that include the full suite of stocks, Forex pairs, trading cryptocurrencies, commodities, fixed spreads , and indices. The interest rates charged by the trading of top regulated forex brokers for stock trading might differ from the market news you got due to the prices or charges added by the exchange prices. Canadian forex brokers often charge reasonable rates from forex traders.

It is a self-regulatory organization established in 2008 and it is non-profit. The regulatory body was created to further strengthen the Investment Dealers Association of Canada. These provinces are 10 in number and are part of the Canadian Securities Administrators . Though they are independent, the CSA recognizes the IIROC as a regulatory body. The response showed us that their support team is quick to respond and is knowledgeable about the services that CMC Markets provides.

Forex Trading Example in Canada

In the forex market, the trading platform you choose can determine the success or failure of your experience. Platforms that are slow to execute may prevent you from taking advantage of the best opportunities. MetaTrader 4 and MetaTrader 5 are two of the most popular and trustworthy platforms offered by most forex brokers in Canada. CMC markets have also received a few rewards for having lucrative options and positively impacting retail investor accounts.

If you have used a particular trading platform in the past, it may make sense to stick with a broker that offers that platform. Brokers are always needed to facilitate trades of currency pairs. Every trader participating in the Forex market uses a broker of some sort .

Who Regulates Forex brokers in Canada?

If you want to trade Forex, first understand that this is a risky proposition. You should be fully aware of the risks of trading currencies before starting. Another important consideration when choosing a forex broker is the payment methods available.

A broker offering sophisticated trading tools, and access to many investable markets and financial products. There are both variable and fixed spreads, depending on the broker. Spreads can vary substantially between brokers, and between currency pairs.

However, some FX brokers may offer proprietary platforms that may not be as widely accepted. As the case may be, ensure that there is a good range of charting tools, indicators, and analysis options, and any additional services you may need as well. You can trade foreign currencies through any number of forex brokers in Canada if you wish to become a forex trader…

The broker is aware of that, and also knows that if the market had moved against Alex, his loss would have been the same. To increase the potential for the profits of its clients, the broker offers leverage . When forex trading in Canada, look out for brokers regulated by the IIROC or the CSA.